Even while increasing your credit card limit or changing interest rates, banks often look at your credit score. You can even invest in small-term investment plans and earn some extra bucks through that too. In fact, most credit cards now allow you to make payments without generating interest for a while. Similarly, car is asset or liability a current account is also a liability for a bank because whatever funds you hold in a current account is something the bank has to return. Additionally, current accounts are heavily operated accounts as they are mainly held by businesses, merchants and enterprises for large and frequent transactions.

It depends on how well a company can manage them effectively. Check your securities/mutual funds/bonds in the Consolidated Account Statement issued by NSDL/CDSL every month. – Build your own trading application with your personalised trading needs. Allows you to manage user portfolios, stream live market data, and more.

Capital account can be regarded as one of the primary components of the balance of payments of a nation. Equity can be defined as the remaining interest of an enterprise over its assets after the deduction of liabilities from it. In short, equity is the excess of aggregate assets over aggregate liabilities. If there is any liability incurred in relation to any of the assets included above the value of liability has also needs to be disclosed under the head liabilities.

- The loss on sale of movable property such as jewellery, car, painting, etc can be a Short Term Capital Loss or Long Term Capital Loss.

- Though it demands a little extra from your pocket, still it is worth buying.

- In case you have not received possession of an under construction property, you need not furnish the details of such property as an under constriction property is not a building.

- Examples of liabilities for a bank include distribution payments to customers from stock, interest paid to customers for savings and fixed deposits.

- Several items can be considered under short-term liabilities.

- Rebate is applicable on total tax liability Section 87A does not exclude any income specifically.

Ntually give you coupons, free vouchers, products, and discounts, something that credit cards are popular with. Increase your credit limit on your credit card but don’t use the entire amount till the limit is provided. It is crucial that you don’t have the extra credit provided to maintain a lower credit utilisation. Credit cards are a liability and not an asset, as the money on the card is not yours and this credit line does not increase your net worth. In fact, credit cards can work as a mode of passive income and help you in multiple ways if used correctly.

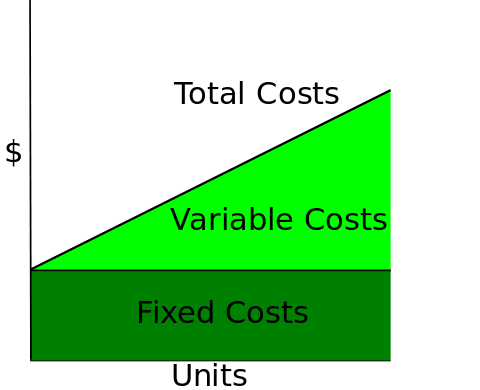

Liabilities

Banks pay interest on the deposits to their Savings Account Holders and Term Deposit Holders. In turn, the bank uses depositors’ money to give loans to borrowers at a higher rate of interest and generate interest income. However, as a matter of prudence, the central bank prohibits the bank to use the entire depositors’ money for lending.

Though these assets are not used for performing daily operations, they tend to help generate significant revenue. Some of the best examples of non-operating assets are short-term investments, vacant land, income generated through fixed deposits, etc. If your score is more than 750, then you are very creditworthy. This will help you get a loan for your car, home, education, etc. very easily even at low-interest rates from a government bank.

Liabilities are debts or obligations that are owed to other people or institutions,” said Anil Pinapala, CEO & Founder of Vivifi India Finance. With ride-hailing companies allow you to turn your vehicle into a source of income through rideshares. One of the most common ways of turning a liability into an asset is through time. Every minute that is spent idly, is for all intents and purposes a liability. Many working individuals look for side hustles and small businesses apart from their regular jobs as a way of better utilizing their time to make more money. No matter how you look at it, a vehicle is a liability as it is almost certain to depreciate in value with time and costs a considerable amount for its operation and upkeep.

I am an avid reader and track developments in financial markets, economy and other market developments. Fixed assets that cannot be converted into cash instantly are known as non-current assets. These provide long-term financial benefits to the owner, business or enterprise. The Income Tax Act does not allow claiming deduction from Section 80C to 80U against LTCG under Section 112. However, the taxpayer can claim Chapter VI-A deductions on capital gains taxable at slab rates. Income from the sale of a car is a Capital Gains and is taxable as per income tax.

Insurance is undertaken to tide over uncertainties in life or business activities. Life insurance plans which have a cash value component are considered an asset. Insurance is an expense to a business and is carried as prepaid expense under the head of current assets in the balance sheet of a company till it is paid. The deposits in the bank accounts is a liability for the bank, as they owe it to their depositors. These deposits are also called Core Deposits of the bank as they form a stable source of funds for lending.

Overview of Capital Adequacy Ratio (CAR)

It is advisable to avoid an impulse decision of buying a four wheeler as it provides negative impact on current financial situation. One must plan this buying decision and should accumulate the down payment in a planned way. Under Third-party insurance, only the damages/losses caused to a third-party person or property are covered as a part of the plan. In case you have an active third party cover and want to protect your own vehicle from damages too, you can opt for an Own Damage cover. One can also opt for a Compulsory Personal Accident cover in case you don’t have one. It compensates the insured owner-driver up to a sum of Rs 15 lac in case of death or permanent disabilities to the insured due to an accident involving an insured vehicle.

Please note that by submitting the above-mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. However, if your taxable income after deductions is upto 5 lakhs, you’re eligible for rebate (12.5k) under section 87A. Deductions, if any, will be reduced from your Income taxable at slab rates. – Invest in mutual funds and manage your portfolio from one place in the CapitPlan app in Android or iOS. For different kinds of investments, we at MoneyIsle have different products and platforms to help you invest in places you want to.

Indus Easy EMI facility gives you the option to convert your high value credit card purchases into easy and flexible EMIs. This benefit stands out between online mode vs. offline mode. Policy seekers are able to compare and analyse several policies of different companies on their own. This enables them to understand where they can derive maximum benefits. The comparable points that generally get checked are – coverage, features, and premium rate. One may be a fantastic driver, but unforeseen circumstances are not in our control, for which we need to be prepared in advance.

I feel that the buying of car with own funds or through loan doesn’t seem to make economic sense, unless the same is required for extensive use. As your vehicle is registered for personal use, the cover will not be valid if the vehicle is found to be used for commercial activities. Claims arising from contractual liabilities are also not covered if the vehicle is not being driven by the insured at the time of the accident.

Using your credit card the right way, for the right reasons, with enough confidence to pay everything back is a healthy practice. Use your card to travel, from booking flights to booking hotels. Using your credit cards on travels will help you grow your points even faster. It represents the amount of capital that allows a bank to absorb losses without affecting the interests of depositors. Tier 1 capital consists of shareholders’ equity and retained earnings. Make your Personal Loan/Business Loan account payment from any bank which offers NEFT / RTGS facility on their internet banking.

FOR ANY SUPPORT ON GST/INCOME TAX

Higher the assets and lower the liabilities, more will be the net worth. Personal finance is not all about savings and investments, but also about managing your expenses and keeping liabilities at the lowest possible level. This move is taken improve environment and reduce vehicular pollution.

Is a car an example of an asset?

Is a Vehicle an Asset? A vehicle that you own outright is generally an asset. However, a financed vehicle could be considered a debt instead of an asset. The fair market value of your vehicle and the amount you owe on it will determine whether it is an asset or a debt.

Final Words, hopefully, you have attained as much knowledge about every type of motor insurance policy insurance companies’ offer. Get the best insurance cover and protect yourself from unseen accidents. I specialise in personal taxes and corporate income tax matters.

I think with the increase in per capita income, people are buying cars. Public transport system is not reliable.This may be the compelling reason to purchase a car. In India, still there is need that socially unfortunate be looked after by providing a relible,accessible,competable public transport infrastructure. Yes we have to as there be compelling social and aspirational reasons to buy it. All you can do is prolong till you feel that it has become an absolute necessary.

I was about to call him but when I read the words “dream possession” in the sms I understood that calling him would make me a villain. If there is any chance that the vehicle is involved in any kind of heinous crimes like murder, staged accidents, or theft, then one cannot avail insurance benefits. Any damage to the vehicle due to war, nuclear radiation/ weapons, rebellions or invasions are not covered. We often come across unexpected severe circumstances that could turn our lives around. It is only a matter of minutes after you have made your choice for your insurance policy to be issued. Individuals do not have to wait endlessly for days to get the policy approval.

Capital Gains on Sale of Jewellery, Car, Painting, etc

It provides financial assistance in case of any damage that occurred due to fire, theft, vandalism, damage caused due to animals, falling objects, riots. Whenever you think of buying insurance cover, opt for the comprehensive cover and feel relaxed as it protects you completely. Third party liability is the mandatory insurance cover for your vehicle to be safe and secured. One has to buy third party liability cover for the mandated purpose under the law of motor vehicle act, 1988.

Tangible Assets- Tangible assets are those assets which can be seen and touched. Those assets which have a physical existence such as Land & Building, Plant & Machinery, Equipment, Computer, Motor Vehicles, Furniture, Stock, Cash etc. No depreciation will be allowed in the year of sale for the car.

Income Tax on Sale & Purchase of Motor Vehicle In India

Customers tend to be ignorant towards Vehicle Insurance due to the rising premium rates. However, it guarantees to be a valuable and essential investment if we look at it from a long-term perspective. RBI proposes to bring in “expected credit loss” based provisioning for banksThe RBI will adopt the ECL approach used in IFRS 9 for prescribing guidelines for loss provisioning by banks. It has also proposed to implement, ECL approach for loss provisioning to all scheduled commercial banks, excluding regional rural banks. RBI plans to change rules on loan loss provisioningThe RBI will adopt the ECL approach used in IFRS 9 for prescribing guidelines for loss provisioning by banks. A person will have a positive net worth till the time he/she manages to keep his/her liabilities lower than his/her assets.

What asset type is a car?

In accounting terms, your car is a depreciating asset. This means your vehicle may have value right now and you could sell it. However, while you own the car, that value usually goes down over time.

As discussed in the context of immovable assets above, for assets not paid for by you, the same principle can be followed for all movable assets. You are required to disclose the details of jewellery and as well as bullion held in the form of bar and coins. For bank balances, you have to provide not only details of saving account but also of balance in any type of a bank account.

What are examples of assets?

- Cash and cash equivalents.

- Accounts receivable (AR)

- Marketable securities.

- Trademarks.

- Patents.

- Product designs.

- Distribution rights.

- Buildings.